COVID-19 and aviation: planning for the ‘new normal’

This article was originally posted on askhelios.com/blog.

The COVID-19 pandemic has already proved devastating for people, businesses, societies and economies around the globe. Whilst many industries have been hard-hit, it is undeniable that global aviation is majorly affected and has entered a deep-freeze in terms of the passenger services provided by airlines. Meanwhile, further to repatriation and emergency flights, air cargo flights continue to operate to ensure critical supplies are distributed across the world, reinforcing the importance of maintaining continuity in air traffic services despite the drop in passenger traffic.

At Helios and Egis, we are well-aware of the hardships posed by COVID-19 on stakeholders across the value chain – from airlines and airports, through to air navigation service providers (ANSPs), suppliers, and institutions. The impacts to our global business are also clear – from travel restrictions, challenges of working remotely, cancellation of key events such as the World ATM Congress and the Farnborough Airshow, through to the disruptions facing our own 17 international airports. As a united and global aviation community, our thoughts are with all those who have been affected. By working together and remaining connected (even virtually), we believe we are able to protect and restore the industry that we love.

In this article, we explore some of the key areas which airlines, airports and ANSPs may wish to focus on to adapt to the ‘new normal’ over the next six to 24 months. As the situation is evolving, this is a first view, and so we look forward to hearing your thoughts. Over the coming weeks, we will update our channels with further insights, sharing with you our thoughts on how to support aviation stakeholders on their road to timely and sustainable business recovery.

Weathering The Storm

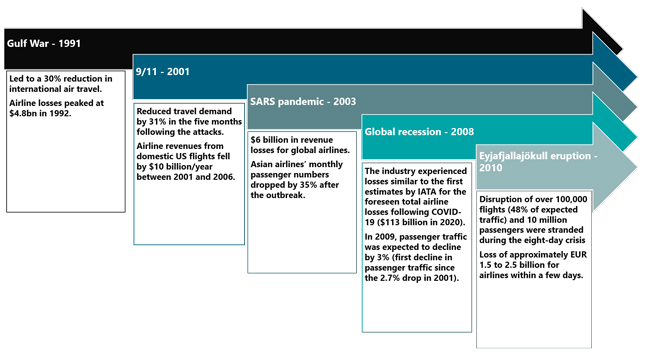

Global aviation is regularly subject to systemic shocks in both costs and demand. Before examining the expected impacts of COVID-19 on global aviation, which have been driven by governmental implementation of travel restrictions, it’s worth reminding ourselves of the impact of the following significant historical events on the air transport sector:(1)

According to IATA forecasts, the COVID-19 pandemic will lead to global airline revenue losses of up to $252 billion in 2020. (2) The impacts on airlines are thus likely to be far worse than what was felt following the global economic recession, both in terms of revenue loss and the speed at which these losses have been incurred. The magnitude and (likely) duration of the disruption caused to aviation are unprecedented:

- Airlines. Airline scheduling data currently shows a decline in global seat capacity of 35%.(3) In Europe, traffic on 28th March 2020 was down by 85% compared to the same operational day in 2019.(4) Main carriers have been drastically cutting flights, and the vast majority of regional and low-cost carriers in Europe have temporarily suspended operations. More generally, global demand is plummeting, cancellations far outweigh forward bookings, and airlines face challenges having sufficient access to liquidity.(5)

- Airports. According to ACI, airports in Europe are expected to witness reductions in passenger traffic of 187 million in 2020, which represent a 7.5% decrease in passenger traffic compared with the previous year.(6) Already on 25th March, almost all major European airports showed traffic below half that on the equivalent day in 2019, notably Barcelona (-90%), Warsaw (-87%) and Rome (-86%). Whilst many hub and cargo airports remain open for non-passenger operations, these airports are facing widespread financial losses and many regional airports have either ceased operations or are on the verge of closure.

- Air Navigation Service Providers. ANSPs are critical components of national infrastructures for the functioning of the air transport system. Despite significantly reduced traffic levels and the challenges of protecting frontline staff from infection, ANSPs have continued to maintain operations(7) to provide essential services for cargo, repatriation, humanitarian and emergency flights. Furthermore, as ANS revenues depend on traffic, ANSPs also face financial losses which are perpetuated by delays in the payment of charges by airlines, or even potentially the suspension of ANS charges for a defined period of time.

Do take a look at our impact assessments at the end of this article which examine these core sectors in more detail. These address the immediate and medium-term implications from a financial, operational, social, environmental and regulatory perspective. We also look forward to hearing from you. Has your organisation experienced similar impacts? And what other implications are your organisation foreseeing going forwards?

Anticipating The ‘New Normal’

Whilst the industry has adapted to deal with the impact of previous crises, it’s clear that the magnitude of the impacts on aviation presented by COVID-19 will be far greater than any downturns the industry has ever experienced. Once our industry regains momentum, we are thus likely to witness the dawn of a ‘new normal’ – among other factors, the return of demand will almost certainly be reduced by society and businesses becoming more comfortable with virtual interactions for otherwise face-to-face meetings. This means that what airlines, airports and ANSPs will be aiming for in terms of recovery might actually be quite different from the environment in which they previously operated.

At present, the focus of the industry is on short-term survival, and rightly so. However, we must not lose sight of the future, as long-term aviation resilience remains vital for the global economy, even given a potential reversal of globalisation that has been mooted in several articles.(8) Airlines, airports and ANSPs will ultimately need to be in a condition to restore full operations when travel bans are lifted and as air traffic begins to pick-up. Alongside dealing with the immediate aftermath, anticipation of this ‘new normal’ thus needs to happen now, to allow for change to be well managed over the next six to 24 months.

Naturally, approaches to planning for the ‘new normal’ will differ for each segment of the market – particularly comparing international airlines and airports with their regional counterparts. The paths that stakeholders take will very much depend on how key business drivers emerge (ie those which have high uncertainty, but would have high business impact)(9), based on factors such as:

- Demand (eg volatile medium-term and lower long-term demand)

- Levels of bankruptcy

- Emergence of new business, ownership and revenue management models

- Changes in the societal perception of flying (eg attitudes towards protecting the environment or the spread of infection as a result of close proximity during flying)

- New market entrants (eg level of market liberalisation)

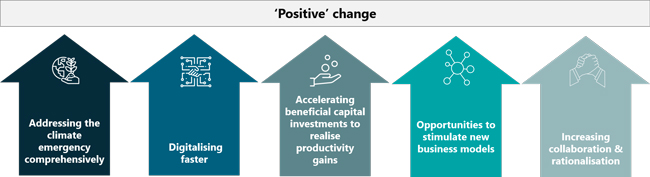

Are there other factors that are likely to strongly influence the future of your business? Ultimately, the earlier the industry starts preparing, the more chance we have of implementing effective business recovery solutions. At the same time, it allows organisations to factor in a wider range of ‘positive’ changes, such as:

Focus Areas For Recovery Planning

Taking into account our impact assessments at the end of this article, we considered where the airline, airport and ATM industries could focus their attention over the next six to 24 months as they prepare for the ‘new normal’.

Indeed, we’ve debated many aspects ourselves and share with you here our most interesting questions and ideas, many of which will also be applicable to our own business. Has your business had the space to consider similar questions? And what other questions are businesses asking? As the situation is rapidly evolving, this is very much a first view, and we look forward to sharing more of our thoughts with you over the coming weeks.

1. What might global aviation look like in a post-pandemic world? At this stage, it is difficult to envisage what the ‘new normal’ will look like, hence making it very difficult for businesses to plan. Given these uncertainties, it will be important for businesses to assess the implications of a number of possible future scenarios, to improve business resilience and agility. It could therefore be worthwhile for decision-makers to consider scenarios such as:

a) Volatile medium-term demand as countries experience secondary waves of the pandemic and as the industry continues to adjust to major changes.

b) Slow recovery but to a new lower capacity – this could result in higher demand for regional travel before long-haul operations resume.

c) Reduced long-term demand due to changes in the societal perception of flying.

d) The above demand scenarios adjusted to take into account industry trends such as digitalisation, sustainability and new market entrants.

2. Are existing business, ownership and revenue models still fit for purpose? Businesses are often forged in crises or forced to change. Business, ownership and revenue models adjust, whether by necessity to survive or through competitive pressures. There could be impetus for stakeholders to build stronger cash reserves to better protect financial health, and for charging and revenue distribution models to evolve in-light of lessons learnt from COVID-19.

3. Depending on financial health, where do organisations stand in terms of their capital expenditure plans? This will be an important question for stakeholders. For example, is this the time to invest or divest? To support financial sustainability, there could be a case for diverting efforts to accelerate CAPEX to focus on long-term productivity and resilience (as opposed to capacity). Stakeholders are also likely to reconsider whether their existing CAPEX projects and deployment schedules are fit for purpose under the ‘new normal’.

4. How could stakeholders best make use of this time? As many businesses are experiencing reduced staffing as a result of sickness, isolation and (in some cases) redundancies or temporary lay-offs, stakeholders could consider ways to best make use of this time in light of limited resource and reduced demand.

From an airport perspective, operators could make use of this time to optimise preparations for planned or confirmed medium-term changes. For example, in terms of airspace change,(10) an airport could consider advancing its Statement of Need (Step 1A of CAP 1616) and/or start preparing its consultation material (Step 3A of CAP 1616) for regulatory approval.

Meanwhile, from an ANS perspective, ANSPs may consider increasing focus on non-ANS services and products to bolster revenues whilst helping to maximise staff productivity.

5. Could systems and infrastructures be adapted to cope with demand volatility? As the industry starts to recover, there may be opportunities to capitalise on digital technologies to:

a) Optimise limited resources in changing contexts.

b) Cope with volatility (eg reducing lead times for recruitment and training and increasing real-time reactivity to changes in demand).

c) Help with staffing issues (ie quicker recovery and restoration of services).

For example, concepts such as ‘digital twins’ offer airports the opportunity to model and optimise their physical assets and processes in a real-time virtual environment. Similarly, remote towers and virtual centres offer ANSPs greater resource flexibility and the ability to best match supply with demand. These are by no means quick solutions, but solutions that could be factored-in during the recovery stage to ensure greater future proofing.

6. What organisational or structural changes might be needed going forwards? Change and challenge often allow decision-makers to explore new opportunities to increase organisational agility. As such, there could be greater momentum for a wider range of ‘positive’ structural changes to be factored into the recovery phase, such as those based on the recommendations stemming from the European Airspace Architecture Study .

7. What technical and operational resilience / contingency measures could help to mitigate the impact of future crises? Traditional crisis management responds to supply-side shocks. Where crises deliver both supply and demand shocks such as COVID-19, stakeholders will need to consider how best they can fall back on their primary accountabilities to provide operations for all critical services (eg ATS services for overflights, emergency and humanitarian aid flights). Using lessons from COVID-19, stakeholders may also consider tailoring their existing collaborative operational readiness exercises to test their own resiliencies and identify where improvements could be made.

Implementing greater levels of automation, for example in aircraft boarding, baggage handling and security systems, should also increase operational resilience through reducing dependency on manual processes and improving consistency in response times. At the same time, automation is likely to reduce long-term operational expenditures and lead to efficiency and productivity gains.

8. What are the impacts of greater State intervention on competition? The industry is witnessing widespread calls for emergency State aid and greater governmental intervention. In a deregulated airline industry, how could this be managed fairly to ensure competition is not distorted? In a regulated ANS industry, how might increased State backing impact the effectiveness of economic regulation and the opening of some ANS services to market conditions under Single European Sky legislation? These are some of the fundamental questions for policy makers and regulators to consider, alongside whether there could be the case for greater public funding to support key aviation infrastructures going forwards.

9. Where do we stand in terms of strategic issues such as climate change? Whilst aviation emissions will have fallen for at least 2020,(11) there is still a need to address the impact of climate change on aviation. As part of the ‘unfreezing’ stage of Lewin’s ‘Change Model’,(12) the effect COVID-19 is having on industry norms means that change towards more environmentally friendly business models could be built into future decision-making (eg EU Green Deal and ICAO CORSIA).

New Norms, New Possibilities

In rapidly changing contexts, the best businesses will be organisationally agile – maintaining perspectives out to six, 12 and 24 months even as they focus resources on managing the short-term. Keeping alive this strategic focus helps not only to weather the storm, but also to position effectively for the ‘new normal’ as their markets and contexts change irreversibly. Looking beyond the hardships posed by COVID-19, what opportunities could today’s challenge and change offer your business to ensure you are resilient and organisationally fit for tomorrow

In times of crisis, the new possibilities stemming from new norms may not seem immediately apparent. So, over the coming weeks, do watch this space as our teams share their thinking on some of the key focus areas for timely and sustainable business recovery.

Impact Assessments For Airlines

Financial

- Foreseen airline revenue losses of up to $252 billion in 2020 (IATA). Previous estimates were at $113 billion – roughly equivalent to industry losses following the global financial crisis.

- As of 28th March, daily traffic from the Schengen area (including UK and Ireland) was down by 75%.

- Threat of bankruptcy depends on numerous factors, including length of outbreak, potential government assistance, cash position and capital structure.

- The largest airlines in the world have sufficient access to liquidity (eg Southwest has a low debt to capital ratio of 25%). By contrast, the vast majority of smaller regional airlines (and some major airlines) do not have enough liquidity to cover two months of operations. (IATA).

- Potential reduction in passenger rights liabilities under Regulation (EC) No 261/2004 if there is reduced demand both at present and under the ‘new normal’.

Operational

- Decisions to operate aircraft depend on both the need and ability to do so.

- Main carriers have been drastically cutting flights and routes. Leading European airline groups are cutting capacity by 75% to 90%. The vast majority of regional / low cost carriers in Europe have temporarily suspended operations (EUROCONTROL).

- To protect supply chains, European air cargo increased by 3% during w/c 16th March (EUROCONTROL).

- Bookings for April 2020 are significantly down compared to April 2019 (eg -80% in China and -50% in Europe) (Sabre).

- Demand may be slow to pick up due to the economic impacts on consumers and the virus-driven ‘fear of flying’. If many countries remain in lockdown, or return into lockdown (eg second wave), schedule disruption in the initial recovery phase may be high. On the supply side, airlines may continue to ground aircraft and certain routes.

- Threat of substitutes (eg regional air travel replaced by regional trains due to societal perception of flying, and increased use of video-conferencing which has been the ‘new norm’).

Social

- Introduction of flexible no change fee policies, and loyalty status extensions for frequent flyers.

- Staffing measures (eg redundancies, unpaid leave, salary cuts).

- Some unions have reached agreements with airlines (eg unpaid leave, temporary off-duty status, temporary suspension of personal pension contributions). Unions have also stepped up calls for government financial intervention to support airlines.

Environmental

- Potential drop in global CO2 in 2020. According to the Centre for Research on Energy and Clean Air, China’s emissions dropped by 25% in Feb 2020 (compared to same period in 2019).

- After the global financial crisis, global CO2 grew 5.9% in 2010 (thus offsetting the 1.4% decrease in 2009) (Politico). This means we could see an increase in emissions following COVID-19 as industries begin to recover and aircraft begin flying again (but arguably not to the same levels as previously foreseen for the next two years).

Regulatory

- Relaxation of regulatory constraints (e. EU slot allocation rules), and provision of emergency State aid for some airlines.

- Calls by airlines to deem COVID-19 as an ‘exceptional circumstance’ under the EU air passenger rights framework.

- EASA Safety Directive on COVID-19 and airline travel (including measures for disinfecting and cleaning aircraft).

Impact Assessments For Airports

Financial

- Impacts on aeronautical and non-aeronautical revenues.

- Delays in payments / debts to airports and subsequently increased risk of bankruptcy. The ownership model of an airport / airport group is likely to play an important role in determining whether an airport risks going into bankruptcy (eg capital structure, level of diversification in the parent company).

- Delays in deploying airport CAPEX and cuts in revenue expenditure with immediate effect.

- Airport groups may be able to afford to run smaller regional airports at a loss, provided the loss is able to be evenly distributed across the group.

Operational

- Challenges of maintaining minimum levels of staffing to enable continuity of airport operations (eg fire brigade and security services).

- Impacts on apron capacity due to the parking of grounded aircraft.

- Many airports are having ground handlers cease operations due to low demand. However, this leaves airports with limited or no ground handling capability for the small number of flights that operate.

- Adaption of airport security screening procedures to attend to passengers wearing face masks and respirators etc.

- In some regions, passengers may need to have some form of medical certification to demonstrate they have either fully recovered or are healthy. This may complicate check-in processes and will require international coordination and modification of passenger handling procedures.

- Variable passenger demand in the medium-term (eg potential second wave of virus / customers are slow to return / societal changes in the perception of flying / pooling of passengers into main airports following the closure of regional airports / threats of substitutes to regional flying such as regional trains).

Social

- Potential issues concerning proximity between passengers and airport personnel (eg at security checkpoints and boarding gates).

- We could see the widespread introduction of thermal screening machines at airports, and more frequent disinfection of arrival gates, buses and other areas for handling passengers.

- Unions and airports are having to make difficult decisions about the future of their staff (eg redundancies, unpaid leave and salary cuts).

Environmental

- In the short-term, less flights mean less aviation emissions and noise pollution around airports.

- As airports focus their immediate efforts on reducing costs, they may be slower to invest in sustainable technologies in the medium-term.

- In the medium-term, there could be a case for greater modulation of airport charges for issues of public and general interest (eg environment issues).

Regulatory

- Proposal by the European Commission to amend common rules for the allocation of slots at EU airports.

- Possible activation of State aid mechanisms to support airports.

- Subsidies may take place between larger and regional airports located within the same terminal charging zone to protect the financial health of smaller airports.

Impact Assessments For ATM

Financial

- Reduced revenues stemming from ANS provision. This results in budgetary restrictions and varying levels of liquidity across ANSPs.

- Member States will be discussing ways to alleviate the impact of the crisis on airlines by reducing ANS charges (eg lowering of unit rates and spreading of adjustments from the previous regulatory period). There may be potential delays in invoicing and the payment of user charges to ANSPs through central route charging offices (if applicable).

- Airlines may request the temporary suspension of ANS charges for a defined period of time. Furthermore, some ANSPs are introducing special discounts in ANS charges for domestic and selected international flights, and extending credit terms to airlines.

- Introduction of measures to reduce ANS and non-ANS costs (eg reduction of overtime to zero hours, no business travel, reduction in training and third-party services).

Operational

- Uncertainties in demand, with the possibility of a new lower demand following the crisis (eg resulting from the bankruptcy of airlines).

- Possible deferral of non-essential training for ATM/ANS operational staff, and implications on medium-term rostering.

- ANSPs will be required to innovate in terms of adapting their operations to make sure operational staff are protected from infection whilst ensuring they are still able to provide the necessary services to remaining traffic (eg cargo, humanitarian or State flights).

- Potential for the prolonged activation of the European Aviation Crisis Coordination Cell (EACCC) at the Eurocontrol Network Manager, with State Focal Points responsible for implementing national actions to ensure continuity of the European ATM network.

Social

- Rostering of ATM/ANS OPS staff. Many ANSPs have placed OPS staff on alternating cycles between operations, standby and mandatory leave. In line with containment and segregation policy, some ANSPs have split their workforce into dedicated teams (eg in case of a positive COVID-19 case, the entire team would be quarantined and OPS would be re-shuffled). The vast majority of non-OPS staff are now required to work from home.

- Support for staff (eg counselling, stress management support, support to payment of medical bills, and housing facilities in case of lockdown of remote regions).

- Introduction of measures to increase staff buffers in the medium-term (eg employees to take leave that has been rolled over from previous years by the end of May).

- Ongoing negotiations with trade unions regarding issues such as salary reduction.

Environmental

- Medium-term improvement in ANS environmental performance. Reduced demand may mean ANSPs are likely to be able to provide more direct routings to airspace users. However, this is subject to the availability of ATM/ANS operational staff, and airspace restrictions such as military airspace usage.

Regulatory

- Implications on ANSP traffic forecasting for ANS regulatory regimes and general planning going forwards (eg rostering).

- Potential for amendments to ANS charging frameworks to alleviate financial impact on airlines and ANSPs.

- In Europe, contingency mechanisms for risk sharing may need to be introduced to accommodate unforeseen changes in traffic and costs of this magnitude, particularly if actual traffic continues to significantly deviate from planned traffic over the remainder of the present regulatory regime.