What the data tells us

Each year since 2022, CANSO conducts a data gathering exercise to collect key facts and figures from our Full Members. This initiative is central to our efforts to track meaningful trends, strengthen our ability to serve as credible voice of ATM and improve our efforts on behalf of members.

As our data request for 2024 data is currently out, we thought it might be interesting to share what we are already learning from the data collected in past years.

Here are five key things we are watching closely.

Investment Rates Globally, Regionally, and by ANSP Size

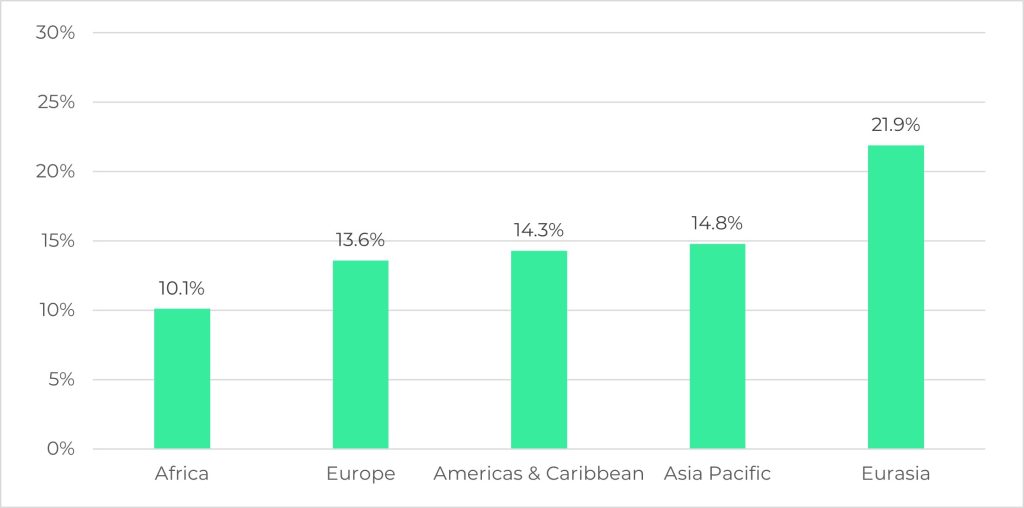

In total, responding ANSPs invested $4.7 billion in Capital Expenditure (CAPEX) in 2023. By taking CAPEX figures and dividing them by reported Operating Expenditure (OPEX) we are able to normalize for ANSPs size and calculate “investment rate” a rough proxy for how much we are investing in our systems and infrastructure as a percentage of our size. Globally the investment rate of reporting ANSPs was 13.3 per cent.

Regional investment rates are shown below:

Not unexpectedly, when grouped into categories by IFR flight hours, larger ANSPs (by IFR flight hours) reported higher investment rates:

- Cohort 1 (over 1 million IFR flight hours): 20 per cent

- Cohort 2 (100,000–1 million IFR flight hours): 13.4 per cent

- Cohort 3 (fewer than 100,000 IFR flight hours): 9.7 per cent

ATCO Replacement Rate

Air Traffic Controllers (ATCO) comprise a significant proportion of the ANSP workforce, making up on average 38 per cent of all employees of reporting organisations.

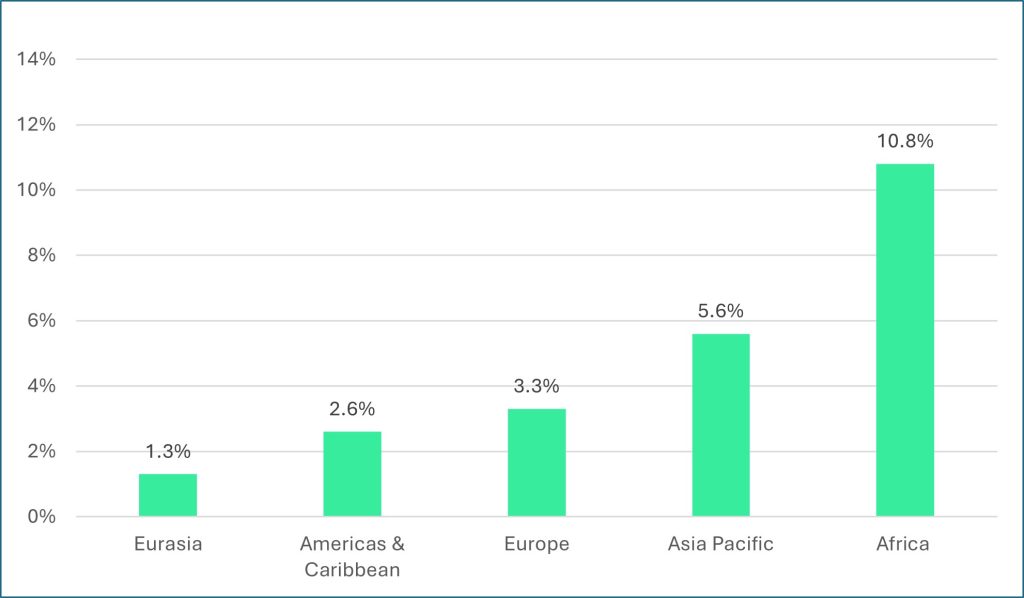

New ATCO licences granted each year as a percentage of total ATCO staffing is a measure that we have begun tracking. This can offer insight into the rate at which ANSPs are replacing ATCOs that retire, or growing overall operational staffing levels, particularly when coupled with age demographic information. Globally the number of new ATCO licences in 2023 represents about 3.5 per cent of total ATC staffing. But there are important differences amongst regions that are evident. Africa and Asia Pacific are licencing new controllers at a rate well above the global average, while other regional fall well below.

Regional replacement rates of responding ANSPs are shown below:

Gender Balance

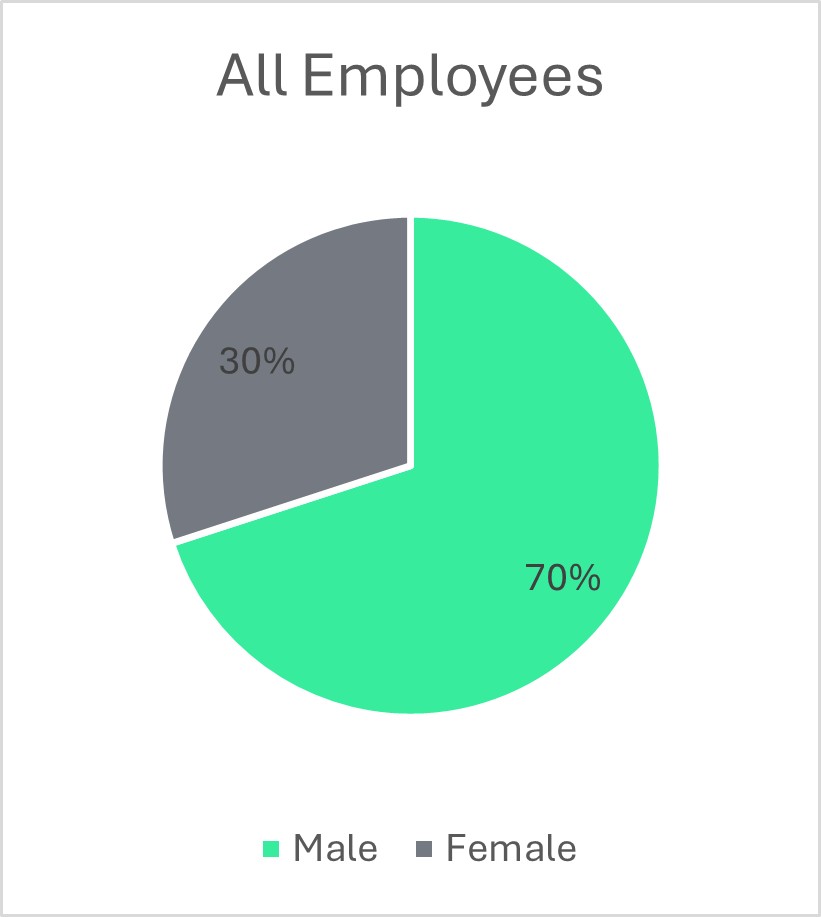

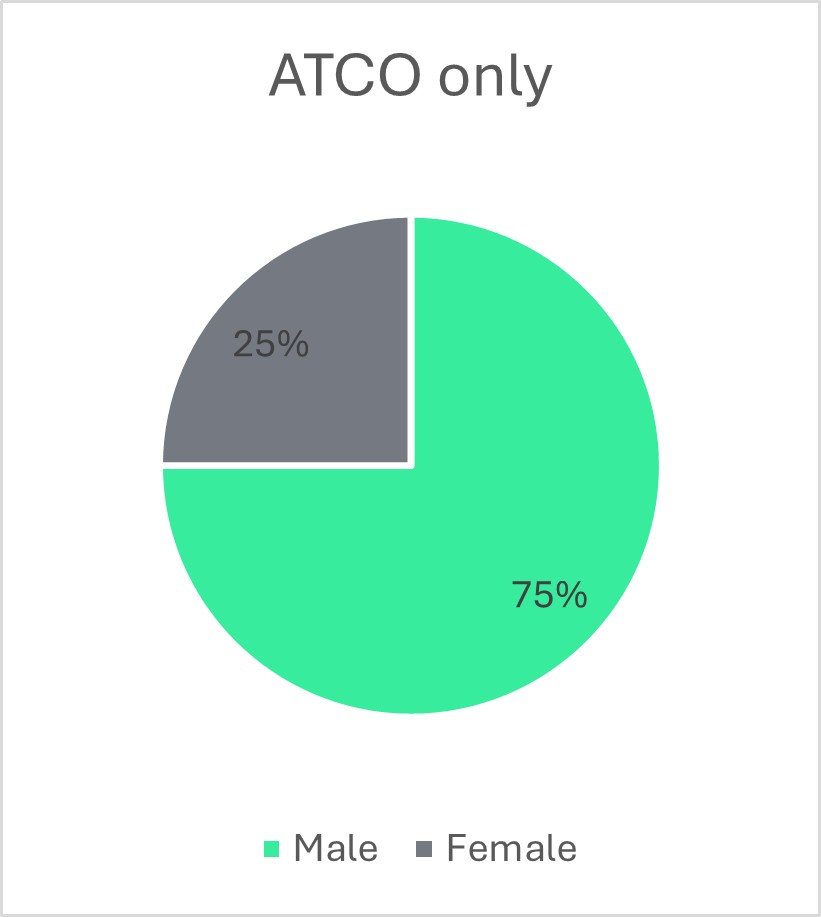

Gender diversity remains an area for improvement across the industry. Globally, 70 per cent of ANSP employees are male, while 30 per cent are female. Globally, 75 per cent of ATCOs are male, while 25 per cent are female. Highest female ratios are found in Latin America & the Caribbean and Asia Pacific.

Cost Recovery Rate

While ANSPs can be funded in a number of diverse ways, we are also tracking “cost recovery rate”, the percentage of ANSP costs that are covered by ATS revenues. This figure has been impacted for several years by pandemic arrangements necessary for ANSPs to pay back debt and in other cases by additional financing from governments, or further diversification of the business. Globally, the cost recovery rate was 87 per cent, meaning that ATS revenues covered 87 per cent of ANSP costs in 2023.

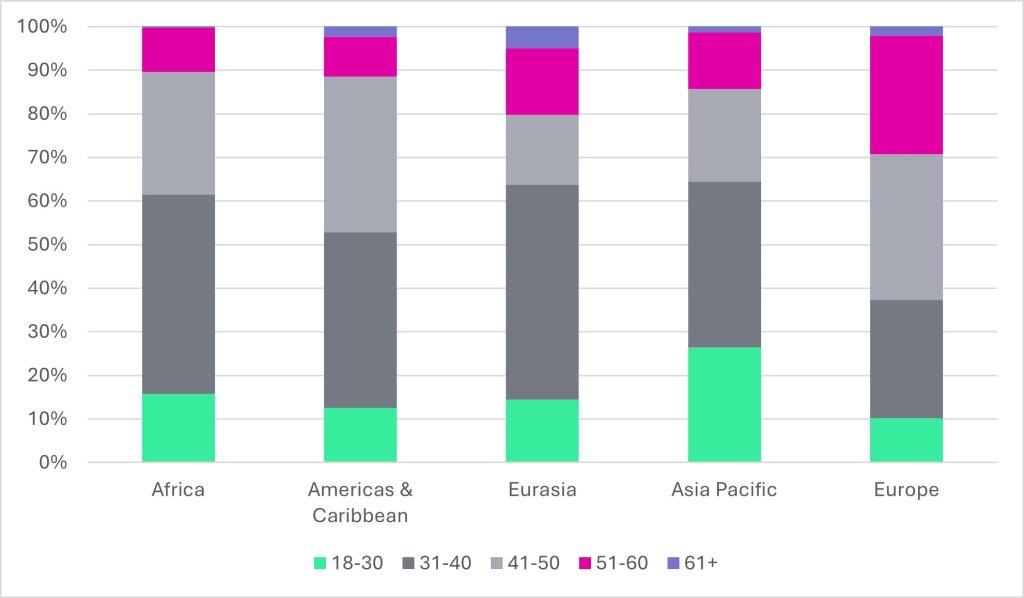

Age Distribution Trends among ATCOs

By looking at age distributions amongst our ATCO workforce over time we can better understand important workforce trends and gain insight into training demands. Understanding that variations in retirement age in different ANSPs will affect these numbers, it is still giving us insight into our workforce. Europe has an older workforce with the smallest percentage under 40 years of age.

Looking ahead

This ongoing data collection exercise provides valuable insights into how our industry is evolving. There’s still time to participate in our current 2025 data gathering exercise. Thank you to all Full Members who have contributed so far.

Interested in how your ANSP’s data compares to regional and global averages? Please contact us at strategy@canso.org for a tailored depiction of how your numbers compare.